LCM Partners wins two Private Debt Investor 2022 awards

PR Newswire

01 Mar 2023, 20:16 GMT+10

LONDON, March 1, 2023 /PRNewswire/ -- LCM Partners is overjoyed to announce that this year it has won two Private Debt Investor Awards: "Distressed Debt and Special Situations Investor of the Year, Europe" and "Speciality Lender of the Year, Europe".

Private Debt Investor is the global publication of record for private debt, tracking the institutions, the funds and the transactions shaping the world's private credit markets. Its annual awards are now in their tenth year with winners selected based on votes received from the publication's readers, including private debt industry participants and the institutional investor community.

This is LCM's seventh win in the European Distressed Debt category with the firm's flagship strategy, Credit Opportunities ("COPS"), acquiring performing, rescheduled and non-performing consumer and SME loans. The Group is also celebrating its 25th anniversary this year as an ever-present operator in the European credit market and these awards are recognition of the firm's market leading position within the alternatives asset class.

In March 2018, LCM launched its speciality finance strategy, SOLO (Strategic Origination & Lending Opportunities), which focuses on granular asset-backed lending via long-term strategic partnerships with established originators. More specifically, SOLO has made significant progress over the last five years building a presence in the renewables sector, funding smaller-ticket assets and service equipment rather than the larger infrastructure assets themselves.

Paul Burdell, CEO of LCM Partners, said:

"This is an excellent way to start what we expect will be another exciting year for LCM. Indeed, macro-economic uncertainty creates an environment in which our strategies thrive. 2022 was a record year in terms of deployment for our special situations and non-performing loan strategy and we believe this may only be the tip of the iceberg. However, we also see a very large opportunity within European speciality finance. We are uniquely positioned to partner with banks, finance companies and original equipment manufacturers (OEMs), who can also benefit from using our proprietary technology and loan servicing capabilities, at a time when capital is becoming increasingly scarce and expensive.

Thank you again to all of our clients and industry peers for supporting our nomination for these prestigious awards. We very much hope to reward the faith they have shown in us in 2023."

LCM Partners

T: +44 203 457 5050

[email protected]

Notes to Editors:

LCM is a leading European alternatives asset manager based in London, which specialises in whole loan consumer and SME credit portfolios. Offering unrivalled expertise in investing in and managing credit portfolios, LCM has approximately 6.9 billion of drawn and/or committed capital and has invested in over 4,700 portfolios of performing, re-scheduled and non-performing loans.

For more information, please visit LCM's website at www.lcmpartners.eu.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Singapore Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Singapore Star.

More InformationInternational

SectionTrump hints at DOGE investigation of Musk subsidies

WASHINGTON, DC - U.S. President Donald Trump on Tuesday claimed Elon Musk's success has been built on government subsidies. Without...

Native leaders, activists oppose detention site on Florida wetlands

EVERGLADES, Florida: Over the weekend, a diverse coalition of environmental activists, Native American leaders, and residents gathered...

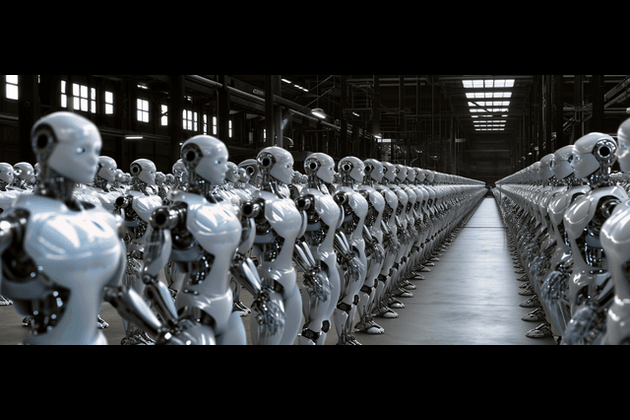

Beijing crowds cheer AI-powered robots over real soccer players

BEIJING, China: China's national soccer team may struggle to stir excitement, but its humanoid robots are drawing cheers — and not...

COVID-19 source still unknown, says WHO panel

]LONDON, U.K.: A World Health Organization (WHO) expert group investigating the origins of the COVID-19 pandemic released its final...

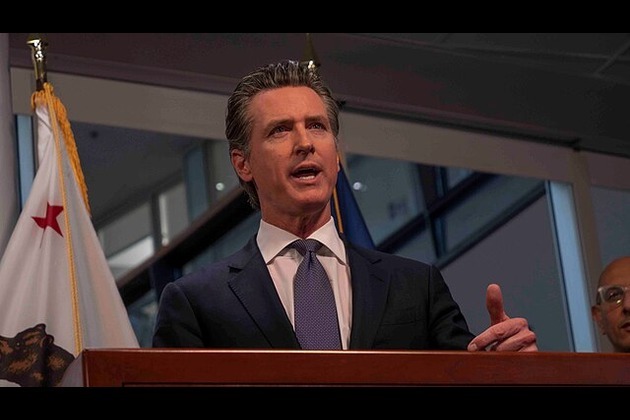

Fox faces $787 million lawsuit from Newsom over Trump phone call

DOVER, Delaware: California Governor Gavin Newsom has taken legal aim at Fox News, accusing the network of deliberately distorting...

DeepSeek faces app store ban in Germany over data transfer fears

FRANKFURT, Germany: Germany has become the latest country to challenge Chinese AI firm DeepSeek over its data practices, as pressure...

Business

SectionNvidia execs sell $1 billion in stock as AI boom drives record prices

SANTA CLARA, California: Executives at Nvidia have quietly been cashing in on the AI frenzy. According to a report by the Financial...

Tech stocks slide, industrials surge on Wall Street

NEW YORK, New York - Global stock indices closed with divergent performances on Tuesday, as investors weighed corporate earnings, central...

Canada-US trade talks resume after Carney rescinds tech tax

TORONTO, Canada: Canadian Prime Minister Mark Carney announced late on June 29 that trade negotiations with the U.S. have recommenced...

Lululemon accuses Costco of selling knockoff apparel

Vancouver, Canada: A high-stakes legal showdown is brewing in the world of athleisure. Lululemon, the Canadian brand known for its...

Shell rejects claim of early merger talks with BP

LONDON, U.K.: British oil giant Shell has denied reports that it is in talks to acquire rival oil company BP. The Wall Street Journal...

Wall Street extends rally, Standard and Poor's 500 hits new high

NEW YORK, New York - U.S. stock markets closed firmly in positive territory to start the week Monday, with the S&P 500 and Dow Jones...