New research by Acuiti and Eventus reveals increase in regulatory requirements, trading environment complexities drives investment in trade surveillance

PR Newswire

29 Nov 2022, 18:30 GMT+10

|  |

LONDON and NEW YORK and SINGAPORE, Nov. 30, 2022 /PRNewswire/ -- The increasing complexity of trade surveillance requirements, driven by regulatory demands and exacerbated by volatility, is putting pressure on manual processes and driving investment in automation, a new study by Acuiti has found.

Acuiti's latest report - "Getting to the risk quicker: How trade surveillance leaders are dealing with an increasingly complex environment" - investigates the challenges facing trade surveillance teams as regulations governing trading have grown in scope, detail and enforcement, and as the sophistication and complexity of trading products and techniques has advanced.

The independent report, commissioned by Eventus, collated the views of 71 senior trade surveillance, risk, compliance, technology and trading executives at banks, brokerages and proprietary trading firms. Eventus, a leading global provider of multi-asset class trade surveillance, market risk and transaction monitoring solutions, commissioned Acuiti to conduct this research project to analyse the key challenges that face banks, brokers and proprietary trading firms when structuring effective trade surveillance operations.

Among the key findings:

- 94% of respondents said that the complexity of trade surveillance has increased over the past three years, with 64% saying it has increased significantly

- Increased regulatory requirements and market volatility are the major drivers of heightened complexity in trade surveillance in the last three years

- A majority of sell-side respondents said that their analysts are spending more than 30 hours a week manually closing and investigating alerts

- High manual input is being exacerbated by a shortage of skilled compliance staff

- Firms are increasingly looking to technology for efficiency, with a clear desire for more automated workflows (64% of banks referring to machine learning as either very important or critical)

- Over 60% of respondents had either recently invested or were considering investing in trade surveillance within the next 12-18 months

- Buy-and-build methodologies couple the advantages of both third-party and in-house solutions

The report found that firms traditionally faced a straight choice between developing their trade surveillance systems in house or outsourcing to a third party.

Both have their drawbacks and selling points, but a new generation of vendors brings together the best of both worlds through buy and build solutions. This could change the equation for many firms that want to both respect guidance from regulators, which according to respondents prefer third-party surveillance solutions, and maintain the ability to customise systems to their best advantage.

Joseph Schifano, Global Head of Regulatory Affairs for Eventus, said: "It's important to help compliance teams respond quickly and with as much detail to potential issues that arise with their surveillance alerts. Automation techniques enable analysts to work with the front office more efficiently, getting to the root cause of any potential issues. Analysts need to customise their technology and mitigate risk based on particular businesses, regulatory jurisdictions and trading activity. Today's surveillance system must enable its users to be nimble and responsive to a rapidly changing global environment, while being explainable to the front office and regulators alike."

"The pressure on the sell-side to maintain high quality trade surveillance systems is immense and unlikely to abate any time soon," said Ross Lancaster, Head of Research at Acuiti. "Regulation and the volatility we have seen this year are creating sustained stresses on compliance desks, and this is increasing the case for strategic investment."

Download the full report at https://www.acuiti.io/acuiti-eventus-getting-to-the-risk-quicker/.

Acuiti is a management intelligence platform designed to provide Senior Industry Professionals in the Derivatives Industry with high-value insight into industry-wide performance and business operations. Acuiti provides a platform through which our exclusive network of Senior Industry Executives can share and source information on day-to-day operational challenges, providing them and their management teams with increased transparency and in-depth analysis to make more informed decisions and benchmark company performance. Financial Institutions benefiting from our services include Banks, Non-bank FCMs, Brokers, Proprietary Trading Firms, Hedge Funds and Asset Managers.

Eventus is a leading global provider of multi-asset class trade surveillance and market risk solutions. Its powerful, award-winning Validus platform is easy to deploy, customise and operate across equities, options, futures, foreign exchange (FX), fixed income and digital asset markets. Validus is proven in the most complex, high-volume and real-time environments of tier-1 banks, broker-dealers, futures commission merchants (FCMs), proprietary trading groups, market centers, buy-side institutions, energy and commodity trading firms, and regulators. The company's rapidly growing client base relies on Validus and Eventus' responsive support and product development teams to overcome its most pressing regulatory challenges. For more, visit www.eventus.com.

Logo - https://mma.prnasia.com/media2/1956994/acuiti_LOGOS_v1_Logo.jpg?p=medium600

Logo - https://mma.prnasia.com/media2/635481/Eventus_Systems_Logo.jpg?p=medium600

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Singapore Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Singapore Star.

More InformationInternational

SectionOver 60 companies named in UN report on Israel-Gaza conflict

GENEVA, Switzerland: A new United Nations report alleges that dozens of global corporations are profiting from and helping sustain...

UK lawmakers desigate protest group as terrorist organization

LONDON, UK - Lawmakers in the United Kingdom have voted overwhelmingly to proscribe the direct-action group Palestine Action as a terrorist...

Dalai Lama to address Buddhist conference, reveal succession plan

DHARAMSHALA, India: The Dalai Lama is set to address a significant three-day conference of Buddhist leaders this week, coinciding with...

US Supreme Court backs Texas efforts to shield minors online

WASHINGTON, D.C.: In a significant ruling last week, the U.S. Supreme Court upheld a Texas law requiring age verification for users...

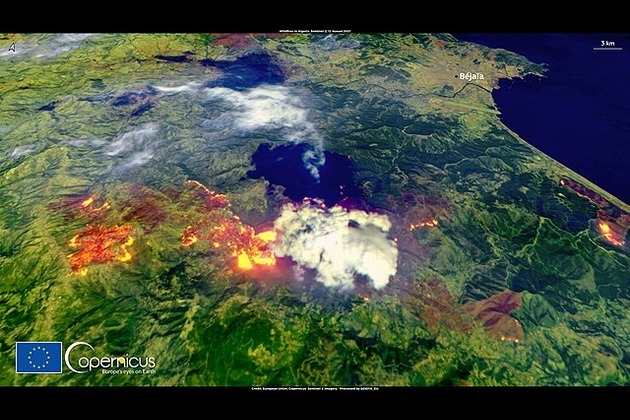

Turkey, France battle wildfires amid early Europe heatwave

ISTANBUL/PARIS/BRUSSELS: As searing temperatures blanket much of Europe, wildfires are erupting and evacuation orders are being issued...

Venetians protest Bezos wedding with march through the town

VENICE, Italy: Over the weekend, hundreds of protesters marched through the narrow streets of Venice to voice their opposition to billionaire...

Business

SectionStandard and Poor's 500 and and Nasdaq Composite close at record highs

NEW YORK, New York -U.S. stock markets closed with broad gains on Thursday, led by strong performances in U.S. tech stocks, while European...

Persson family steps up H&M share purchases, sparks buyout talk

LONDON/STOCKHOLM: The Persson family is ramping up its investment in the H&M fashion empire, fueling renewed speculation about a potential...

L'Oreal to buy Color Wow, boosts premium haircare portfolio

PARIS, France: L'Oréal is making a fresh play in the booming premium haircare segment with a new acquisition. The French beauty conglomerate...

Robinhood launches stock tokens for EU investors, adds OpenAI

MENLO PARK, California: Robinhood is giving European investors a new way to tap into America's most prominent tech names — without...

Wall Street diverges, but techs advance Wednesday

NEW YORK, New York - U.S. stocks diverged on Wednesday for the second day in a row. The Standard and Poor's 500 hit a new all-time...

Greenback slides amid tax bill fears, trade deal uncertainty

NEW YORK CITY, New York: The U.S. dollar continues to lose ground, weighed down by growing concerns over Washington's fiscal outlook...