Adani becomes India's second largest cement player

PR Newswire

16 Sep 2022, 20:15 GMT+10

Completes acquisition of Ambuja Cements and ACC

- Largest acquisition in India's Infrastructure and Materials space valued at USD 6.50 billion

- Post the transaction, Adani will hold 63.15% in Ambuja Cements and 56.69% in ACC (of which 50.05% is held through Ambuja Cements)

- The combined market capitalization of Ambuja Cements and ACC is USD 19 billion as on date

- With this acquisition, Adani is now India's second largest cement manufacturer (capacity 67.5 MTPA)

- Enhanced corporate governance with 100% independent directors on Audit Committee and Nomination & Remuneration Committee

- Two new Board committees - Corporate Responsibility Committee and Public Consumer Committee - comprising solely of independent directors, will drive ESG assurance and consumer-first approach

AHMEDABAD, India, Sept. 16, 2022 /PRNewswire/ -- The Adani Family, through Endeavour Trade and Investment Ltd ("BidCo"), a special purpose vehicle, has successfully completed the acquisition of Ambuja Cements Ltd and ACC Ltd. The transaction involved the acquisition of Holcim's stake in Ambuja and ACC along with an open offer in both entities as per SEBI Regulations.

The value of the Holcim stake and open offer consideration for Ambuja Cements and ACC is USD 6.50 billion, which makes this the largest ever acquisition by Adani, and also India's largest ever M&A transaction in the infrastructure and materials space. Post the transaction, Adani will hold 63.15% in Ambuja Cements and 56.69% in ACC (of which 50.05% is held through Ambuja Cements).

"What makes cement an exciting business is the headroom for growth in India, which exceeds that of every other country well beyond 2050," said Mr Gautam Adani, Chairman, Adani Group. "Cement is a game of economics dependent on energy costs, logistics and distribution costs, and the ability to leverage a digital platform to transform production as well as gain significant supply chain efficiencies. Each one of these capabilities is a core business for us and therefore provides our cement business a set of unmatched adjacencies. It is these adjacencies that eventually drive competitive economics. In addition, our position as one of the largest renewable energy companies in the world will help us manufacture premium quality green cement well in line with the principles of a circular economy. All of these dimensions put us on track to become the largest and most efficient manufacturer of cement by no later than 2030."

Currently, Ambuja Cements and ACC have a combined installed production capacity of 67.5 MTPA. The two companies are among the strongest brands in India with immense depth of manufacturing and supply chain infrastructure, represented by their 14 integrated units, 16 grinding units, 79 ready-mix concrete plants and over 78,000 channel partners across India.

The Board of Ambuja Cements approved an infusion of INR 20,000 Cr into Ambuja by way of preferential allotment of warrants. This will equip Ambuja to capture the growth in the market. The actions will significantly accelerate value creation for all stakeholders, in line with the Adani Group's business philosophy.

Both Ambuja Cements and ACC will benefit from synergies with the integrated Adani infrastructure platform, especially in the areas of raw material, renewable power and logistics, where Adani Portfolio companies have vast experience and deep expertise. Ambuja and ACC will also benefit from Adani's focus on ESG, Circular Economy and Capital Management Philosophy. The businesses will continue to be deeply aligned to UN Sustainability Development Goals with clear focus on SDG 6 (Clean Water and Sanitation), SDG 7 (Affordable and Clean Energy), SDG 11 (Sustainable Cities and Communities) and SDG 13 (Climate Action).

In line with the Adani Portfolio's governance philosophy, the board committees of both Ambuja Cements and ACC have been reconstituted. The Audit Committee and the Nomination & Remuneration Committee now comprise 100% independent directors. Further, two new committees have been constituted - the Corporate Responsibility Committee and the Public Consumer Committee - both comprising 100% independent directors to provide assurance to the board on ESG commitments and maximise consumer satisfaction. Also, a Commodity Price Committee has been constituted, comprising 50% independent directors, to strengthen risk management.

The transaction was financed by facilities aggregating to USD 4.50 billion availed from 14 international banks. Barclays Bank PLC, Deutsche Bank AG and Standard Chartered Bank acted as Original Mandated Lead Arrangers and Bookrunners to the transaction. Barclays Bank PLC, DBS Bank, Deutsche Bank AG, MUFG Bank and Standard Chartered Bank acted as Mandated Lead Arranger and Bookrunners to the transaction. In addition, BNP Paribas, Citibank, Emirates NBD Bank, First Abu Dhabi Bank, ING Bank, Intesa Sanpaolo S.p.A, Mizuho Bank, Sumitomo Mitsui Banking Corporation and Qatar National Bank acted as Mandated Lead Arrangers for the transaction.

Barclays Bank PLC and Deutsche Bank AG acted as M&A advisors to BidCo, with Standard Chartered Bank acting as the Structuring Advisor, and ICICI Securities and Deutsche Bank AG acted as merchant bankers to the open offer by BidCo for Ambuja Cements and ACC.

Cyril Amarchand Mangaldas and Latham and Watkins LLP acted as M&A counsel to BidCo. Cyril Amarchand Mangaldas and Latham and Watkins LLP also acted as legal counsels to BidCo for the financing with Allen & Overy LLP and Talwar Thakore and Associates acting as legal counsels to the lenders.

About the Adani Portfolio

Headquartered in Ahmedabad, India, the Adani Group is the largest and fastest-growing portfolio of diversified businesses in India with interests in Logistics (seaports, airports, logistics, shipping and rail), Resources, Power Generation and Distribution, Renewable Energy, Gas and Infrastructure, Agro (commodities, edible oil, food products, cold storage and grain silos), Real Estate, Public Transport Infrastructure, Consumer Finance and Defence, and other sectors. Adani owes its success and leadership position to its core philosophy of 'Nation Building' and 'Growth with Goodness' - a guiding principle for sustainable growth. The Group is committed to protecting the environment and improving communities through its CSR programmes based on the principles of sustainability, diversity and shared values.

Further information at www.adani.com.

SOURCE Adani Group

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Singapore Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Singapore Star.

More InformationInternational

SectionMembers allowed to switch as Medicaid provider loses accreditation

ANNAPOLIS, Maryland: Maryland's largest managed care organization for Medicaid recipients has had its accreditation suspended, prompting...

US aircraft carrier in South Korea after North Korea's missile tests

SEOUL, South Korea: A U.S. aircraft carrier reached South Korea over the weekend, shortly after North Korea test-fired cruise missiles...

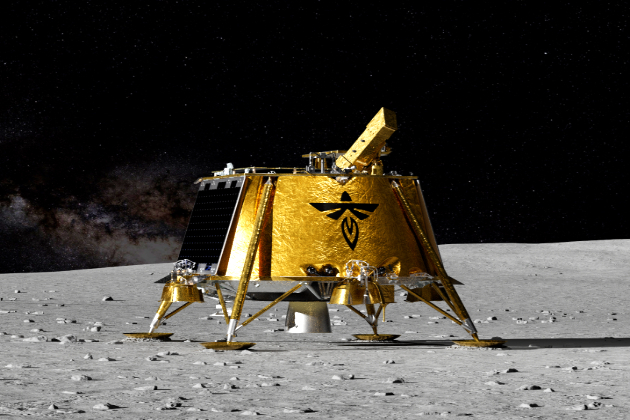

Marking a first, Firefly Aerospace's Blue Ghost lands on the moon

WASHINGTON, D.C.: Firefly Aerospace has achieved a major milestone in private space exploration, successfully landing its Blue Ghost...

NASA launches satellite to map moon's water resources

CAPE CANAVERAL, Florida: This week, a small NASA satellite was launched into space from Florida to find and map water on the moon....

Japan’s birth rate hits record low amid aging population

TOKYO, Japan: The number of babies born in Japan fell to a record low of 720,988 in 2024 for a ninth consecutive year, the health ministry...

Guterres says West Bank settlement expansion and threats of annexation must stop

CAIRO, Egypt - UN Secretary-General Antonio Guterres has warned of the 'alarming situation' unfolding in the West Bank, and says the...

Business

SectionVietnam to fast-track licensing for Elon Musk's Starlink services

HANOI, Vietnam: Vietnam is set to fast-track licensing for Elon Musk's Starlink satellite internet service, while also exploring ways...

Wall Street rebounds after Trump relents on some tariffs

NEW YORK, New York - U.S. stocks were highly volatile on Wednesday with the major indices jumping back and forth into negative territory....

Gear malfunction forces Volkswagen US to recall over 60,000 vehicles

RESTON, Virginia: Volkswagen is recalling more than 60,000 vehicles in the U.S. after a gear display malfunction was identified, which...

Meta plans paid subscription for AI chatbot

MENLO PARK, California: Meta Platforms is gearing up to introduce a paid subscription service for its AI-powered chatbot, Meta AI,...

China’s factory slump continues, raising stimulus calls

BEIJING, China: China's manufacturing sector is expected to shrink for a second consecutive month in February, signaling continued...

U.S. stocks join global rout over trade war fears

NEW YORK, New York - U.S. stocks dived, then partially recovered Tuesday as 25 percent import duties on goods from Canada and Mexico...