BRI is Implementing a Buyback of Its Shares until August 2023

PR Newswire

01 Sep 2022, 13:23 GMT+10

JAKARTA, Indonesia, Sept. 1, 2022 /PRNewswire/ -- PT Bank Rakyat Indonesia (Persero) Tbk. (IDX: BBRI) is implementing a buyback of its shares to a maximum total value of IDR 3 trillion from 1 March 2022 until 31 August 2023. BRI obtained the approval from its shareholders to carry out the buyback through the Annual General Meeting of Shareholders (AGM) on 1 March 2022, in accordance with the Disclosure of Information, where the shares will be used for the BRI employees.

BRI President Director Sunarso said that the company already considered the liquidity condition so as not to disrupt the company's finances. "The buyback of BRI shares is projected to increase the motivation of BRI's employees to be more optimal in achieving targets, thus increasing the company's performance."

"In addition, the buyback will be used for the need of treasury stock, which will ultimately be used as long-term performance incentives for high-performing employees. We see that BRI's share price is still undervalued, especially compared to the company's performance achievements. This affirms us to continue to do the buyback," added BRI Finance Director Viviana Dyah Ayu.

CSA Research Institute Senior Analyst, also the Secretary General of the Indonesian Securities Analysts Association (AAEI) Reza Priyambada is optimistic about the corporate action that illustrates BRI's management strategy for economic recovery and projected future performance in Indonesia. The buyback will support the company's growth as employees will be more motivated if they own shares of the company. "This will further support BRI's growth if we believe this economic recovery will continue, and the Indonesians are persistent with their work."

BRI's positive performance was reflected in a recorded net profit of IDR 24.88 trillion or grew 98.38% year-on-year (YoY) in Q1 2022. Meanwhile, total assets increased 6.37% YoY to IDR1,652.84 trillion. On a consolidated basis, lending reached IDR1,104.79 trillion or grew 8.75% YoY.

BRI's MSME loan portfolio grew 9.81% from IDR 837.82 trillion in June 2021 to IDR 920 trillion in June 2022, which increased the proportion of MSME loans to 83.27% of the total financing portfolio.

This achievement was accompanied by sound risk management, with a consolidated non-performing loan (NPL) ratio maintained at 3.26%. BRI's management also has prepared anticipatory measures for potential loan quality deterioration, with an NPL coverage of 266.26%.

For more information, visit www.bri.co.id.

SOURCE PT Bank Rakyat Indonesia Tbk (BRI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Singapore Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Singapore Star.

More InformationInternational

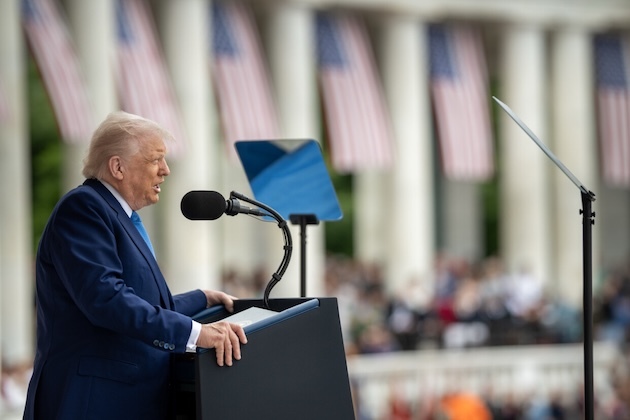

SectionGod responsible for his presidency, claims Trump

WASHINGTON, DC - U.S. President Donald Trump on Monday said he believed God was behind his election loss in 2020, even though he has...

Passenger traffic plummets at Newark Airport amid travel disruptions

NEW YORK CITY, New York: Passenger numbers at Newark Liberty International Airport in New Jersey have dropped sharply, according to...

EU probes Visa, Mastercard fees amid antitrust scrutiny

BRUSSELS, Belgium: European Union antitrust regulators are examining fees imposed by payment giants Visa and Mastercard, Bloomberg...

US Army to list only birth sex in transgender soldiers' records

WASHINGTON, D.C.: The U.S. Army plans to change the records of transgender soldiers to list only their sex at birth, according to a...

US FAA orders flight reductions at Newark Airport to ease congestion

WASHINGTON, D.C.: The Federal Aviation Administration (FAA) said this week that it will require airlines to reduce the number of flights...

Nine children from 1 family die as Israel Air force pilots hit 100 targets in Gaza

GAZA - The home of a doctor working in the emergency room at the Nasser Medical Complex in southern Gaza was struck by Israel Air...

Business

SectionBuilder discounts drive sales spike, but housing outlook wary

WASHINGTON, D.C.: New single-family home sales in the U.S. rose sharply in April to their highest level in over three years as builders...

CEO says health push weakened Nestle, vows return to F&B roots

VEVEY, Switzerland: Nestle is realigning its focus on its core food and beverage operations after expanding into areas like health...

Ford sues California law firms over alleged Lemon Law fee fraud

DEARBORN, Michigan: Ford Motor Company has filed a lawsuit against several California lawyers and law firms, accusing them of cheating...

US drug launch prices double in four years, Reuters finds

BRUSSELS, Belgium: U.S. drugmakers are charging significantly more for new treatments, particularly those targeting rare diseases,...

Allegations of secret nursing home deals shake UnitedHealth

MINNETONKA, Minnesota: UnitedHealth shares took a sharp hit this week, after a report by the UK's Guardian alleged the healthcare giant...

Trump-backed $1.5 billion golf project breaks ground near Hanoi

HUNG YEN, Vietnam: A new US$1.5 billion luxury golf and residential project backed by the Trump Organization officially broke ground...