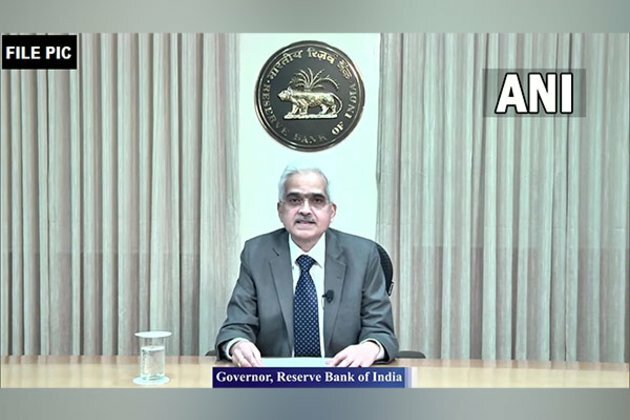

Cryptocurrencies are a clear danger, need to guard against any disruption to financial stability: RBI Governor

ANI

30 Jun 2022, 19:48 GMT+10

Mumbai (Maharashtra) [India], June 30 (ANI): Cryptocurrencies are a clear danger and anything that derives value based on make-believe, without any underlying, is just speculation under a sophisticated name, RBI Governor Shaktikanta Das has said in the foreword of the Financial Stability Report (FSR) released on Thursday by the Reserve Bank of India (RBI).

Referring to the FSR report, the RBI Governor said that stress test results presented in this FSR demonstrate that banks are well-positioned to withstand even severe stress scenarios"A noteworthy feature of the current situation is the overall resilience of Indian financial institutions, which should stand the economy in good stead as it strengthens its prospects. This reflects a combination of good governance and risk management practices, as highlighted in this issue of the Financial Stability Report. Stress test results presented in this FSR demonstrate that banks are well-positioned to withstand even severe stress scenarios without falling below the minimum capital requirement," he said.

"Even so, we must be mindful of the emerging risks on the horizon. Cryptocurrencies are a clear danger. Anything that derives value based on make believe, without any underlying, is just speculation under a sophisticated name. While technology has supported the reach of the financial sector and its benefits must be fully harnessed, its potential to disrupt financial stability has to be guarded against. As the financial system gets increasingly digitalised, cyber risks are growing and need special attention," he added.

The Financial Stability Report also noted that cryptocurrencies pose risks.

It said cryptocurrencies, typically created on decentralised systems, are "designed to bypass the financial system and all its controls, including Anti Money Laundering (AML)/Combatting the Financial Terrorism (CFT) and Know Your Customer (KYC) regulations".

"They are characterised by highly volatile prices. As a sub-class of cryptocurrencies, stablecoins are supposedly less volatile as they are linked to a currency (or similar assets)."The report said that currently, the market capitalisation of a total of 19,920 cryptocurrencies trading on 528 exchanges stands at $908.7 billion10, with Bitcoin accounting for 44 per cent of this market capitalisation.

"The top two cryptocurrencies account for 59 per cent while the top five account for more than three-fourths. Cryptocurrencies are not currencies as they do not have an issuer, they are not an instrument of debt or a financial asset and they do not have any intrinsic value. At the same time, cryptocurrencies pose risks," the report said.

"Historically, private currencies have resulted in instability over time and in the current context, result in 'dollarisation', as they create parallel currency systems, which can undermine sovereign control over the money supply, interest rates and macroeconomic stability."RBI said that for developing economies, cryptocurrencies can erode capital account regulation, which can weaken exchange rate management. "Furthermore, cryptocurrencies can lead to disintermediation from the formal financial system, impairing financial stability," it added.

The report said that crypto assets have gained in popularity in emerging market economies in recent years, especially in countries with volatile exchange rates. "For residents in these countries, crypto-assets pegged to reserve currencies such as USD-linked stablecoins are a convenient tool to avoid capital controls and KYC/AML requirements."The report said that recent regulatory measures have focussed on curtailing the solvency risk of financial entities, promoting market-based financing and reducing the moral hazard of unduly prolonged policy support.

"At the same time, high levels of global debt, monetary policy tightening, risks associated with the cryptocurrency ecosystem and climate-related risks and more recently, geopolitical conflict posed threats to global financial stability," it said. (ANI) Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Singapore Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Singapore Star.

More InformationInternational

SectionMoscow removes Taliban from banned list, grants official status

MOSCOW, Russia: This week, Russia became the first country to officially recognize the Taliban as the government of Afghanistan since...

Netanyahu vows 'No Hamas' in postwar Gaza amid peace talks

CAIRO, Egypt: This week, both Hamas and Israel shared their views ahead of expected peace talks about a new U.S.-backed ceasefire plan....

US sends message by publicizing visa ban on UK punk-rap band

WASHINGTON, D.C.: The Trump administration has made public a visa decision that would usually be kept private. It did this to send...

Tragedy in Spain: Diogo Jota and his brother die in car accident

MADRID, Spain: Liverpool footballer Diogo Jota and his younger brother, André Silva, have died in a car accident in Spain. Spanish...

Early heatwave grips Europe, leaving 8 dead and nations on alert

LONDON, U.K.: An unrelenting heatwave sweeping across Europe has pushed early summer temperatures to historic highs, triggering deadly...

U.S. military, China, Russia in Space race

President Donald Trump's plans to build a space-based Golden Dome missile defense shield have drawn immediate criticism from China,...

Business

SectionUS debt limit raised, but spending bill fuels fiscal concerns

NEW YORK CITY, New York: With just weeks to spare before a potential government default, U.S. lawmakers passed a sweeping tax and spending...

Shein hit with 40 million euro fine in France over deceptive discounts

PARIS, France: Fast-fashion giant Shein has been fined 40 million euros by France's antitrust authority over deceptive discount practices...

Meta hires SSI CEO Gross as AI race intensifies among tech giants

PALO ALTO/TEL AVIV: The battle for top AI talent has claimed another high-profile casualty—this time at Safe Superintelligence (SSI),...

Engine defect prompts Nissan to recall over 443,000 vehicles

FRANKLIN, Tennessee: Hundreds of thousands of Nissan and Infiniti vehicles are being recalled across the United States due to a potential...

Microsoft trims jobs to manage soaring AI infrastructure costs

REDMOND, Washington: Microsoft is the latest tech giant to announce significant job cuts, as the financial strain of building next-generation...

Stocks worldwide struggle to make ground Friday with Wall Street closed

LONDON UK - U.S. stock markets were closed on Friday for Independence Day. Global Forex Markets Wrap Up Friday with Greeback Comeback...