Sri Lanka Bondholders Announce Formation of Group

PR Newswire

21 Jun 2022, 18:00 GMT+10

NEW YORK, June 21, 2022 /PRNewswire/ -- More than 30 institutional holders of the 11 outstanding series of international bonds (the "Bonds") issued by the Democratic Socialist Republic of Sri Lanka ("Sri Lanka") have organized a bondholder group (the "Group") to represent the interests of international investors in the expected restructuring of Sri Lanka's debt.

The Group is prepared to engage constructively and collaboratively with the Sri Lankan authorities and other important domestic and international stakeholders as part of a comprehensive debt restructuring process aimed at securing an outcome that is both equitable to creditors and responsive to the economic and social challenges facing Sri Lanka.

The Group is broadly representative of Sri Lanka's bondholder base, both by type of institution and by geography, and holds Bonds across each outstanding series. The aggregate outstanding Bonds, totalling US$12.6 billion, constitute approximately 50% of Sri Lanka's total foreign currency denominated central government debt.

A steering committee of the Group has been established which comprises funds and accounts managed or advised by a variety of institutions based in the US, Europe and Asia, including, among others, Amundi Asset Management, BlackRock and its subsidiaries, Eaton Vance Management, Grantham, Mayo, Van Otterloo & Co. LLC, HBK Capital Management, Morgan Stanley Investment Management, Neuberger Berman, T. Rowe Price Associates, Inc., and Wellington Management.

The Group welcomes the authorities' ongoing engagement with the International Monetary Fund (the "IMF"), and encourages the authorities to formulate and implement a package of meaningful reforms and fiscal adjustments to restore the conditions for sustainable and inclusive growth and support the long term prosperity of Sri Lanka.

The Group is ready to interact swiftly with the authorities and the IMF to help achieve a timely resolution of Sri Lanka's debt related challenges. To this end the Group expects that the forthcoming process will be conducted in a manner consistent with the G20-endorsed Principles for Stable Capital Flows and Fair Debt Restructuring, which emphasise transparency, good faith negotiations and fair treatment among creditor classes.

The Group has retained White & Case LLC and Rothschild & Co as legal and financial advisors respectively for this process.

Holders of Sri Lanka's international Bonds who wish to learn more about the Group and its objectives are encouraged to reach out to [email protected] and/or [email protected]

SOURCE White & Case LLP

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Singapore Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Singapore Star.

More InformationInternational

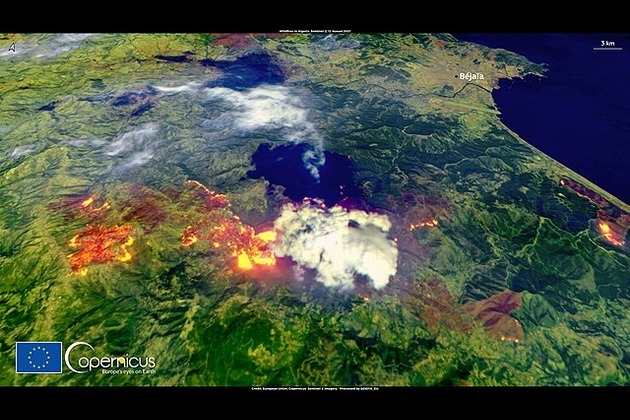

SectionTurkey, France battle wildfires amid early Europe heatwave

ISTANBUL/PARIS/BRUSSELS: As searing temperatures blanket much of Europe, wildfires are erupting and evacuation orders are being issued...

Venetians protest Bezos wedding with march through the town

VENICE, Italy: Over the weekend, hundreds of protesters marched through the narrow streets of Venice to voice their opposition to billionaire...

New French law targets smoking near schools, public spaces

PARIS, France: France is taking stronger steps to reduce smoking. A new health rule announced on Saturday will soon ban smoking in...

Trump hints at DOGE investigation of Musk subsidies

WASHINGTON, DC - U.S. President Donald Trump on Tuesday claimed Elon Musk's success has been built on government subsidies. Without...

Native leaders, activists oppose detention site on Florida wetlands

EVERGLADES, Florida: Over the weekend, a diverse coalition of environmental activists, Native American leaders, and residents gathered...

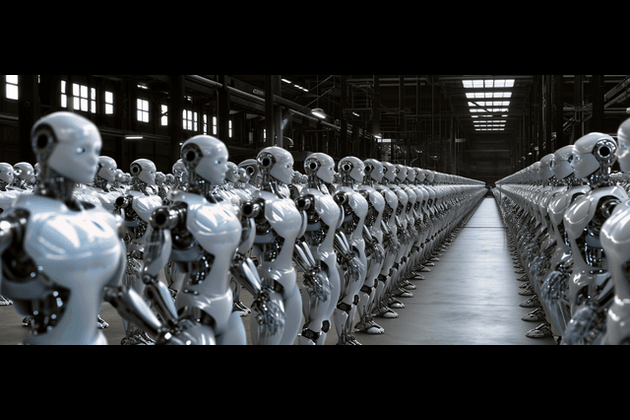

Beijing crowds cheer AI-powered robots over real soccer players

BEIJING, China: China's national soccer team may struggle to stir excitement, but its humanoid robots are drawing cheers — and not...

Business

SectionWall Street diverges, but techs advance Wednesday

NEW YORK, New York - U.S. stocks diverged on Wednesday for the second day in a row. The Standard and Poor's 500 hit a new all-time...

Greenback slides amid tax bill fears, trade deal uncertainty

NEW YORK CITY, New York: The U.S. dollar continues to lose ground, weighed down by growing concerns over Washington's fiscal outlook...

Taliban seeks tourism revival despite safety, rights concerns

KABUL, Afghanistan: Afghanistan, long associated with war and instability, is quietly trying to rebrand itself as a destination for...

Nvidia execs sell $1 billion in stock as AI boom drives record prices

SANTA CLARA, California: Executives at Nvidia have quietly been cashing in on the AI frenzy. According to a report by the Financial...

Tech stocks slide, industrials surge on Wall Street

NEW YORK, New York - Global stock indices closed with divergent performances on Tuesday, as investors weighed corporate earnings, central...

Canada-US trade talks resume after Carney rescinds tech tax

TORONTO, Canada: Canadian Prime Minister Mark Carney announced late on June 29 that trade negotiations with the U.S. have recommenced...