Gold prices on the rise amid fears of worldwide inflation

RT.com

23 Oct 2021, 15:42 GMT+10

The price of gold this week exceeded $1,800 per ounce, trading data shows. While global investors assess the risks of high inflation, some experts say gold prices could soon double.

The price of December gold futures on the New York Comex stock exchange on Friday jumped 1.69%, to $1812.15 per ounce. Over the week, gold has risen in price by some 2.5%, its fastest weekly growth rate since spring.

The popularity of the precious metal has grown as it is seen as a means of protection against high inflation, a common trend in many countries around the globe despite the assurances of the financial authorities that the phenomenon is temporary.

Kitco analyst Jim Wyckoff, who is quoted by the Wall Street Journal, believes gold prices "are supported by growing fears about inflation and a decline in the dollar index at the end of the trading week." In recent weeks, the dollar has been weakening against a number of major world currencies, in particular, the euro, the yen and the yuan, while the dollar index has dropped by 0.2%, to 93.58 points.

"Experience shows that 'hard' assets such as precious metals are becoming more popular as a hedge of inflation," Wyckoff stated.Meanwhile, industry insiders think gold prices could potentially rise further, likely following the lead of other major commodities, like aluminum and natural gas, as Covid-19 pandemic aftershocks continue to frustrate supply chains.

According to the former chiefs of Canadian gold mining company Goldcorp Inc., David Garofalo and Rob McEwen, global inflationary pressures are not as transitory as central bankers and consumer price indexes suggest. When investors realize this, it could propel gold prices up to $3,000 an ounce.

"I'm talking about months. The reaction tends to be immediate and violent when it does happen. That's why I'm quite confident that gold will achieve $3,000 an ounce in months not years," Garofalo, who now heads Gold Royalty Corp, told Bloomberg. He noted that because gold is a universal asset and has a some 4,000-year history, it is better positioned than, for instance, cryptocurrencies as a hedge against an inflationary environment. McEwen noted that the post-pandemic global monetary and debt expansion combined with supply disruptions will inevitably lead people to traditional methods of protecting their capital, with gold the leading choice.

For more stories on economy & finance visit RT's business section

(RT.com)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Singapore Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Singapore Star.

More InformationInternational

SectionGreta Thunberg, others stopped while attempting to break Gaza blockade

WEST JERUSALEM, Israel: Israeli forces stopped a boat heading to Gaza and detained Greta Thunberg and other activists on board early...

Fresh IVF error raises alarm over clinic safety and oversight

MELBOURNE, Australia: A second embryo mix-up in just two months has pushed one of Australia's largest IVF providers back into the spotlight,...

Trump and Musk feud goes viral on X

WASHINGTON, D.C. A public fight between U.S. President Donald Trump and billionaire Elon Musk has taken over social media, especially...

Human traffickers exploit new deadly route from Africa to Europe

DERA BAJWA, Pakistan: Amir Ali, a 21-year-old man from Pakistan, dreamed of going to Europe for a better life. He was promised a visa...

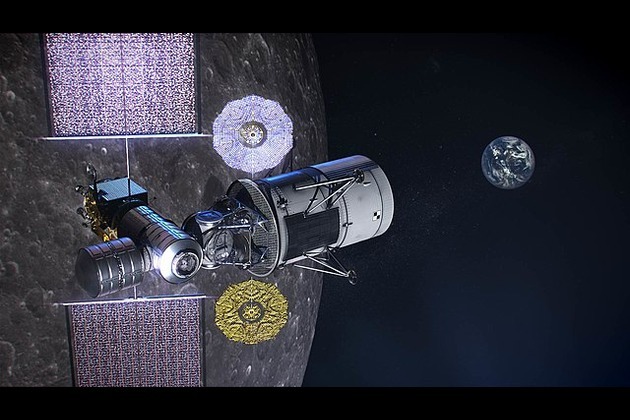

ispace lander crashes on moon; Japan faces new lunar setback

TOKYO, Japan: Japan's hopes for a foothold in commercial lunar exploration suffered a second blow this week after Tokyo-based startup...

FSB claims Russian professors linked to British Council espionage

MOSCOW, Russia: Russia's principal security agency, the Federal Security Service (FSB), has accused British intelligence of using the...

Business

SectionOil prices flat amid trade talks and rising OPEC+ output

NEW YORK CITY, New York: Oil prices remained steady on June 9 as investors looked ahead to the outcome of the U.S.-China trade talks...

Coal vs. water: India’s energy push fuels local shortages

CHANDRAPUR/SOLAPUR (India): As India doubles down on coal to fuel its growing energy needs, an invisible crisis is surfacing: the country...

Nasdaq Composite climbs 124 points on China-U.S. trade talks optimism

NEW YORK, New York - U.S. stock markets rose Tuesday as investors and traders anticipated a positive outcome from ongoing trade talks...

Beijing approves rare earth shipments to top three US automakers

BEIJING/WASHINGTON, D.C.: In a rare move aimed at easing mounting supply chain pressure, China has issued temporary export licenses...

UBS faces $26B capital demand under Swiss post-crisis plan

BERN, Switzerland: UBS faces a sweeping new capital requirement from the Swiss government, which this week proposed changes that could...

Inside the viral world of Walmart’s high-paid cake artists

NEW YORK CITY, New York: At a Walmart Supercenter in New Jersey, buttercream borders and edible-ink cartoons aren't just about sweet...